The United States continues to be a global leader in embracing the cryptocurrency industry thanks to the work of Sen. Patrick Toomey, with the White House being at the forefront of crypto regulation. Last year, President Joe Biden signed a $1.2 trillion bipartisan infrastructure bill — and it included some new legislation that would impact the crypto sector. And more recently, the U.S. president announced a “whole-of-government” approach to regulating cryptocurrency in an across-the-board executive order directing multiple government agencies to answer specific questions on cryptocurrencies. The U.S. for the last year has clearly been seeking to help make the crypto industry more sustainable, which will make it significantly easier for cryptocurrency platforms to operate.

But the Stablecoin Transparency of Reserves and Uniform Safe Transactions Act of 2022, dubbed the Stablecoin TRUST Act for short, makes the U.S. likely the only country, or at least the only Western country, to fully regulate and accept stablecoins as an official part of the financial and banking system.

Introduced by Sen. Toomey, the ranking member of the Senate Banking Committee, the Stablecoin TRUST Act forces stablecoin issuers to adhere to certain rules. The regulations in the act are sweeping and comprehensive. The bill clarifies that payment stablecoins are not securities, which is a great thing for the industry. The bill also refers to stablecoins as “payment stablecoins” — digital assets that can be “convertible directly to fiat currency by the issuer” and that have a “stable value relative to a fiat currency or currencies.”

Related: Regulations set the table for more talent, capital and building in crypto industry

Stablecoin issuers would have to choose between securing the Office of the Comptroller of the Currency (OCC) license, a state money transmitter, or similar license or a traditional bank charter. Stablecoin issuers operating in the U.S. would be subject to a disclosure regime that would require them to secure regular audits, detail clear redemption policies and specify what actually backs the stablecoins they issue.

Any need for a U.S. CBDC?

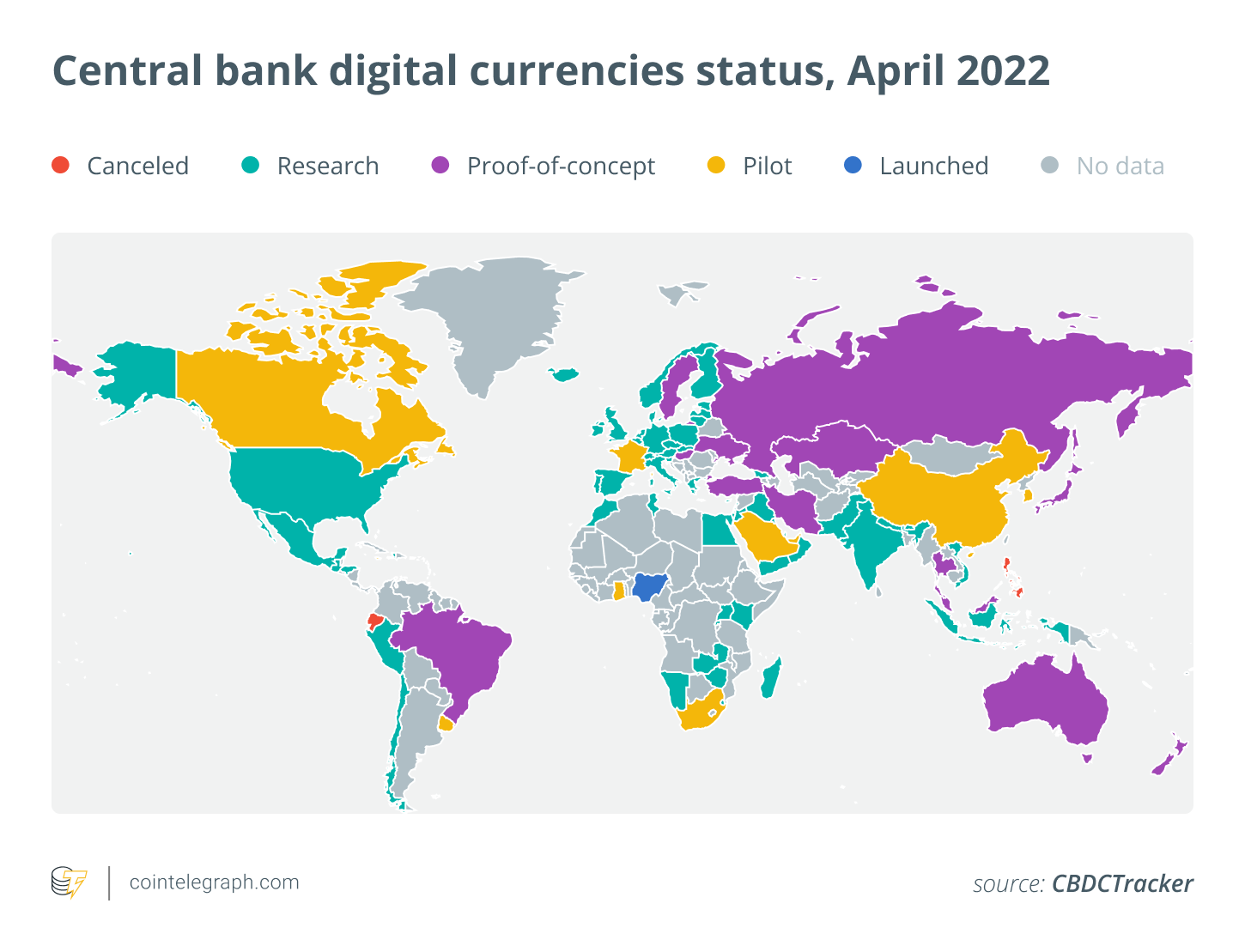

With the discussion draft of the bill circulating and garnering feedback in congress, I beg the question: If the act becomes law, would the U.S. government still need to develop a central bank digital currency (CBDC), or what some call the digital dollar?

It doesn’t appear to be necessary for the U.S. to develop a digital dollar if private stablecoin issuers are accepted as part of the broader financial system. Would there be a need for the government to have both private and public digital dollars, one issued by providers and another by the federal government? These questions will play out over the coming months as U.S. regulators continue to tackle them.

But it’s clear that part of Biden’s executive order includes placing “urgency on research and development of a potential United States CBDC, should issuance be deemed in the national interest,” according to an accompanying fact sheet released by the White House.

Related: Fitting the bill: US Congress eyes e-cash as an alternative to CBDC

It would be the first time in history in which a nation allows both private stablecoin issuers and the government-issued stablecoin to operate in a single market. Some countries have banned private stablecoins because they want to promote their own CBDC, but the U.S. is taking a different route that could spur significant innovation in the stablecoin industry — and, of course, make it more transparent and sustainable. But there are problems, with possibly serious consequences.

Interest rates will be capped — expect consolidation

The Stablecoin TRUST Act regulates what assets can back their USD-pegged stablecoins, which would be cash, where interest rates are incredibly low, and Treasury Bills (T-Bills), where interest rates aren’t much better. This poses a major problem to both current stablecoin issuers and future players, as they won’t be able to earn higher interest from riskier assets.

Right now, certain stablecoin issuers back most of their tokens by higher paying commercial papers, which cannot be evaluated without more transparency and an audit. According to USDT stablecoin issuer Tether on March 31, 2021, over 65% of their reserves were backed by commercial papers, only around 4% were backed by cash, and about 3% are backed by T-Bills. Therefore, Tether and other stablecoin providers will have to completely change the composition of their reserves to fall in line with the Stablecoin TRUST Act if it becomes law.

Competition may slow down in the stablecoin industry and we may see some consolidation. Since stablecoin issuers will not be able to use higher-paying assets to generate high interest, it will become difficult for them to make profit while managing compliance risk, HR taxes and general management costs.

Related: Regulators are coming for stablecoins, but what should they start with?

The big players will find a way to make it work, more than likely, but smaller stablecoin issuers will find it difficult to make profit if the bill becomes law.

Let’s get the Stablecoin Trust Act passed

Although the Stablecoin TRUST Act may set up some barriers to new participants in the industry, I do believe that it will make the industry more transparent and sustainable. Enforcing disclosure and redemption requirements for the USD stablecoins will make them significantly more safe and transparent in the future.

One of the best parts about the Stablecoin TRUST Act is that it really does bring stablecoins into the traditional U.S. financial system. OCC-licensed issuers will have access to the Federal Reserve’s master account system, which would give them the ability to tap the broader financial system and larger amounts of liquidity in transacting.

There is still some time before the Stablecoin TRUST Act becomes law, but if it stays true to its current form, the U.S. will continue to set the gold standard in cryptocurrency regulation. So, let’s work together to make sure that the act becomes law.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Raymond Hsu is the co-founder and CEO at Cabital, a cryptocurrency wealth management platform. Prior to co-founding Cabital in 2020, Raymond worked for fintech and traditional banking institutions, including Citibank, Standard Chartered, eBay and Airwallex.

Comments are closed.