No, Jack Dorsey, venture capital will not run Web3

In his monthly crypto tech column, Israeli serial entrepreneur Ariel Shapira covers emerging technologies within the crypto, decentralized finance and blockchain space, as well as their roles in shaping the economy of the 21st century.

Jack Dorsey, Twitter’s ex-CEO and Bitcoin (BTC) aficionado, is not a big fan of Web3 — or at least of what its grand vision is shaping up to be. Users won’t own the next iteration of the internet, he asserts again and again. Instead, venture capital funds pumping millions into blockchain and Web3 projects will be the ones to hold the reins. But, will they, though?

The reality, as usual, is not as partial as either side would have you believe. In essence, Web3 is the dream of an internet free from the grasp of centralized platforms such as, well, Twitter. Different commentators also include other features such as an end to pervasive surveillance, more decentralization, data that’s understandable to both people and machines and AR/VR functionality. But, at the core, it seems, the Web3 movement is about bringing down the big fish.

In its current shape and form, after all, the internet is indeed quite centralized in a lot of ways. Just four companies run almost 70 percent of the global cloud infrastructure that is home to millions of web pages and applications. All the familiar faces are also encroaching on the crucial infrastructure making up the web’s backbone. And, platforms like Twitter and Facebook have largely centralized the way we consume content, becoming the window into the wider web for many — just look at Facebook’s standoff with Australian news publications.

Jack argues that the whole Web 3.0 brouhaha is ultimately a lot like a coup. A group of upstarts comes together, striking up a plot to overthrow the royalty, but they are only doing that out of self-interest. They have no thoughts to spare for the layman out there. And, should they win, little would change in the kingdom other than the banners flying over the capital.

Related: A letter to Zuckerberg: The Metaverse is not what you think it is

In code we trust

So, is there anything in Web3 for the laypeople of the centralized kingdom? The reality is, as usual, complicated.

It is undeniably true that Web3 is a hot topic in the VC world. It’s not just a16z bringing forth this vision. There’s also Iconium, a private investment fund focused on digital assets and decentralized projects, investing in networks like Secret and Terra and dozens of other funds large and small. All in all, VCs pumped $33 billion into blockchain startups in 2021 and this figure speaks for itself — but not necessarily with the implication of control.

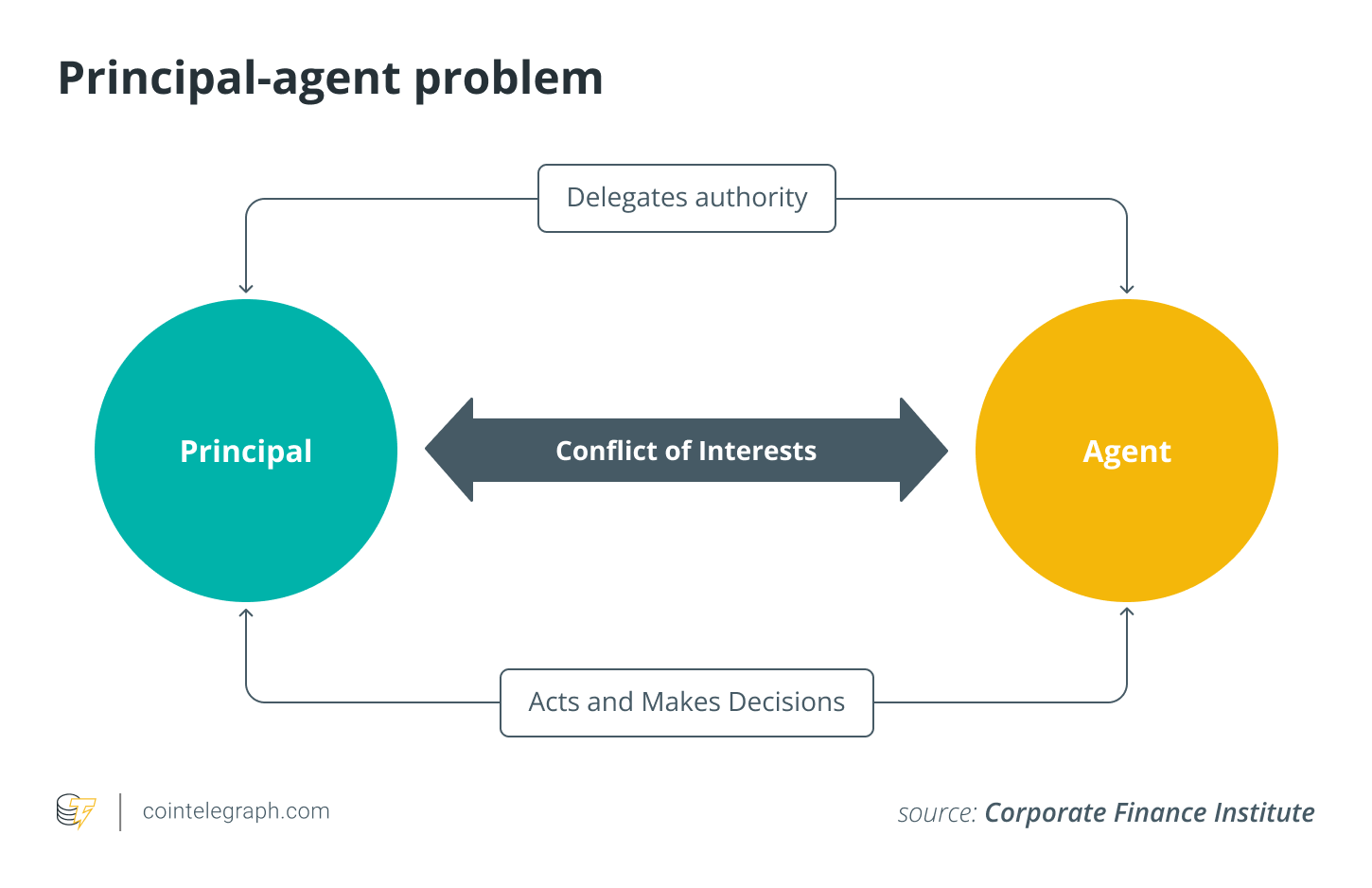

In the digital world, you reap what you code. Code is the law, blockchain enthusiasts like to say, and even though the crypto community itself didn’t always live by this principle, it is a rallying cry for some of its more purist advocates. The idea behind it is that the code is a more unbiased judge than any centralized entity could ever be, and so, in code we trust.

While the sentiment may be a bit naive, this focus on the code is worthy of further discussion. Things like the pervasive surveillance that users deal with today stem from the code powering the platforms they use. The reason why Facebook and Twitter services pull in your data is that they were coded that way. This design, for its part, stems from a specific business model from the Web2 era: You pay for the free service with your privacy.

Related: The data economy is a dystopian nightmare

By extension, though, an app without hard-coded consumer surveillance is fundamentally incapable of spying on the users. Neither is it capable of exercising any form of control over anything it’s not built to control in the first place. And, as long as it happens to sit on a public blockchain where its code is open for review, users will be able to inspect its limitations themselves. Those who don’t speak Solidity will still be able to hear from those who do, as the open-source community is generally always abuzz with insightful discussions and opinion-sharing.

The changing tides of investing

Don’t be mistaken: VCs are not charities, they are very much interested in returns on their investment. The question is, though, where do these returns come from? In this respect, things are different from project to project, but in most general economic terms, blockchain projects are all about tokens. Sometimes, it’s not positive, as victims of any of the recent rug pulls may testify, but for VCs, that’s essentially how they cash out. They invest by buying tokens from the project and profit from selling it when it takes off. More often than not, it’s that simple.

A VC investing in an invasive app taking a jab at the established giants fits into Dorsey’s argument. And, yes, a decentralized application (DApp) can hypothetically be as invasive as a centralized one. A VC investing in a privacy-first open-source project in hopes of cashing out on its token does not. Neither can accrue any kind of outsized power in the hypothetical decentralized internet of tomorrow unless projects they invest into explicitly hand them this power — which is something the community can keep tabs on.

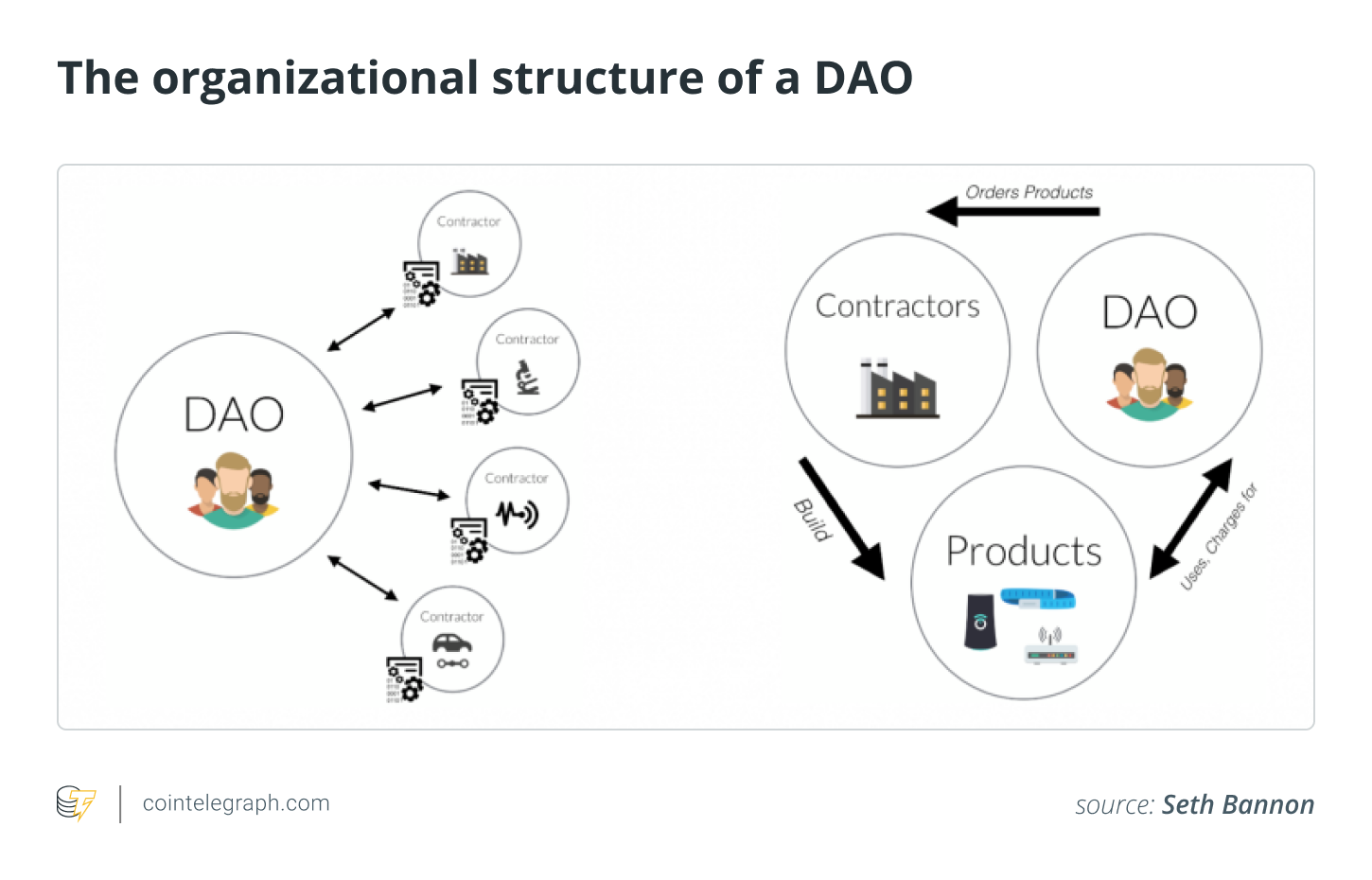

Furthermore, the face of investing is changing. The push for decentralization has given rise to decentralized autonomous organizations, or DAOs, which often come together around a specific vision or an investment. In a somewhat similar vein, projects like dHEDGE, a social asset management protocol, give retail investors a chance to pool their assets together under the guidance of a skilled manager or algorithm and put them to work. Both approaches will ultimately lead to more democratized and more conscious investing, which also runs against what Dorsey is charging.

Related: DAOs are the foundation of Web3, the creator economy and the future of work

All in all, the tale of Web3, as it often happens with big ambitions and big words, is now marketing buzz and speculation as much as it is genuine technological ingenuity and a push for a better web for all. Something like this inevitably takes a bit of cynicism to process without falling into any of its many caveats, but it is just as important to look out for the diamonds in the rough. That is exactly what investors are doing. There may never be a single tectonic shift in the Web3 foundations, but as more and more decentralized projects take off that offer users genuine value beyond purely financial terms, the Big Tech grasp on the Internet may indeed give way to a new paradigm, one that won’t ultimately give us more of the same.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Ariel Shapira is a father, entrepreneur, speaker, cyclist and serves as founder and CEO of Social-Wisdom, a consulting agency working with Israeli startups and helping them to establish connections with international markets.