How API Copilot on Delta Exchange Lets You Run Complex Crypto Trading Strategies Without Coding

Most traders nowadays want automation – faster moves, less emotional decision-making, and a shot at 24/7 market opportunities – but then hit a wall when it comes to coding. If you’ve tried scripting your own strategy, you know it’s a time-consuming headache: debugging, wrestling with Python syntax, and hoping a rogue comma doesn’t wipe your portfolio. Even pro developers get tripped up by API documentation and edge-case errors.

What’s worse, many off-the-shelf algo trading platforms cost a premium and still require you to write or copy code. At this point, most non-coders give up or rely on basic manual trading tools, missing out on smarter, automated strategies.

API Copilot on Delta Exchange transforms how crypto traders automate complex strategies, letting anyone trade algorithmically without touching actual code.

In this post, we’ll break down how it works, why it matters, and how traders are using it to level up their automated crypto trading strategies.

API Copilot: Delta Exchange’s Tool for Automation

API Copilot on Delta Exchange solves this coding bottleneck in an easy way. It sits right inside the platform, as a user-friendly AI assistant tuned to the needs of crypto traders – not generic coders. You can interact with Copilot much like texting a friend or using ChatGPT, only now – with a crypto trading focus – it’s actually writing, fixing, and explaining code as you build your strategies.

A notable brownie point of API Copilot is that it responds to plain English, so we can outline ideas, trading conditions, or risk controls, and get a Python script in seconds. No more trawling through outdated API docs or hiring a developer for minor tweaks.

For traders, this means less friction and faster iteration: test, refine, and automate strategies on the same day.

Building and Testing Strategies Without Coding

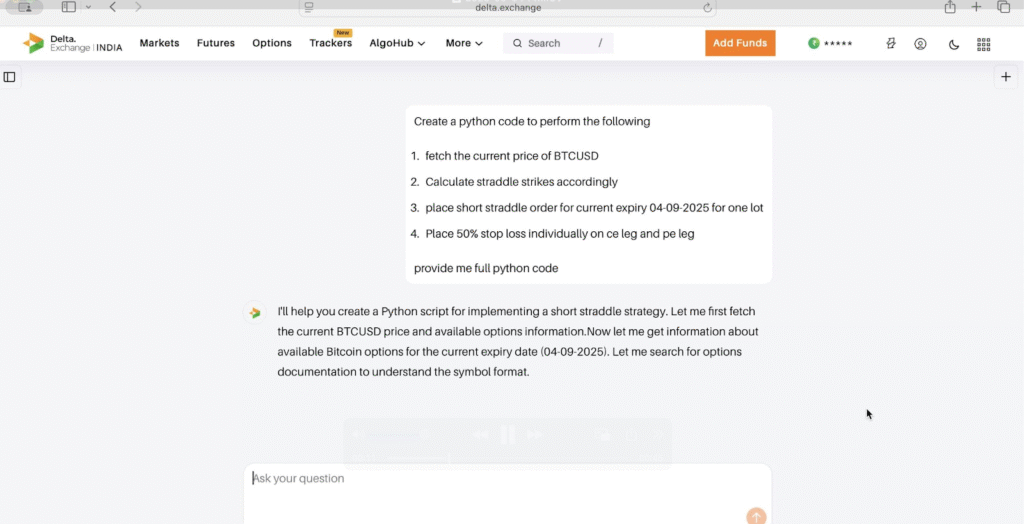

Code generation user input

Here’s a walkthrough of a typical experience:

Let’s say you’re interested in BTC futures and want to automate buying whenever the price drops a certain percentage within an hour. Instead of parsing documentation or writing code from scratch, you need to simply describe your idea to API Copilot. In moments, you will receive a customized script, ready for testing.

API Copilot can also help debug errors, walk through order placement logic, and explain tricky aspects like WebSocket connections or market data access – making the whole process more approachable for newcomers and time-saving for experts.

Step-by-Step Setup: Getting Started with API Copilot on Delta Exchange

Follow these quick easy steps to get started with API Copilot:

- Register on Delta Exchange using basic details and complete KYC to unlock trading features.

- Browse the platform’s derivatives offerings to get familiar with available products.

- Navigate to AlgoHub and create an API key under the API tab.

- Once the key is set, go back to AlgoHub. API Copilot will be live, ready to assist in building, automating, and testing strategies.

This seamless, integrated experience means that you’re not shuffling between different platforms or tools – everything is already available at your fingertips.

Benefits that Go Beyond Basic Automation

Delta Exchange is more than just APIs – it offers advanced tools and features that simplify trading:

- INR support for effortless deposits and withdrawals, so no multi-currency headaches for Indian traders.

- Direct integrations with TradingView, Tradetron, AlgoTest, and NextLevelBot, which allow you to supplement or connect existing strategies without complex third-party setups.

- Low minimum lot sizes, sometimes as little as ₹2,500 to ₹5,000, so you’re able to experiment with ideas without risking large amounts of capital.

- Risk-free demo accounts, perfect for testing crypto trading strategies until you’re confident enough to commit real funds to your automated trading.

- Fast, reliable executions make sure your algo trading bots don’t lag behind market moves – a must for both retail and institutional traders.

Why Does API Copilot Matter?

Delta Exchange’s API Copilot makes running crypto trading strategies hassle-free

For years, there was a clear divide in crypto trading: coders could automate, scale, and backtest almost anything, while the rest had to rely on intuition, slow manual orders, or pricey signal services. API Copilot democratises this space – a trader with no prior coding experience can bring creative ideas to life, test them, and run complex automated strategies in production.

The world of crypto APIs is booming, projected to reach nearly $8 billion by 2035, with use cases multiplying from simple trade execution to advanced risk management and portfolio hedging. With Copilot, every trader has a shortcut into this growing market.

Realistic Expectations and Risk Awareness

While API Copilot can bridge the technical gap, it’s important to remember that successful trading still relies on sound strategy, market awareness, and risk management. Automation amplifies ideas, but it doesn’t guarantee profits or shield anyone from crypto volatility.

Using demo accounts and small lot sizes is a safe way to validate new strategies. Always be sure to review risk profiles and don’t jump into fully automated trading without testing and tweaks.

To Sum Up

API Copilot makes algo trading approachable and flexible for anyone – even those with zero coding background. It’s part of a broader shift in the crypto trading space towards inclusivity, speed, and strategy-first experimentation. Whether you’re building simple triggers, executing on price movement, or running complex multi-leg options spreads, the process is fluid, iterative, and much less stressful.

If you’re looking to test your next crypto trading strategy, consider trying out API Copilot. For traders aiming to compete in fast-moving markets, this is a step toward smarter, more automated decision-making.

To start testing crypto trading strategies with API Copilot, visit www.delta.exchange and join the community on X for the latest updates.

Disclaimer: Investing in cryptocurrency entails bearing the high risk of market volatility. Kindly research before investing.