The cryptocurrency market is known for its high volatility and the wild-west nature of the space is, in part, due to many of the assets having small market caps and the 24/7 operational hours of centralized and decentralized exchanges (DEXs).

In addition to being high risk, crypto trading can also be a very time-intensive process. It can be an overwhelming task and a barrier to entry for most investors in determining which tokens to invest in.

For these investors, index investing could be a profitable alternative for gaining exposure to some of the hottest sectors of the cryptocurrency market.

Here’s a look at how crypto index products compare to individual tokens and which strategies have produced the biggest return.

Index Cooperative

Index Cooperative (INDEX) is a decentralized autonomous asset manager that allows investors to create a custom index of tokens using smart contracts.

Several of the most actively traded indexes originated from Index Coop, including the DeFi Pulse Index (DPI), Metaverse Index (MVI), Data Economy Index (DATA) and Bankless DeFi Innovation Index (GMI).

Plotting the price of these indexes against the total market capitalization of the cryptocurrency market can help provide insight into how each one performed compared to the market as a whole.

Since May 29, 2021, which is when data first became available for DPI and MVI on TradingView, the weakness of the decentralized finance (DeFi) sector can be seen in the poor performance of DPI, which is currently down more than 50% while the total market cap has risen 19.82%.

During that same period of time, the Metaverse index has increased 103% when compared to the price of Ether (ETH), and the gains are even greater when looking at its value in terms of USD.

As seen on the chart above, the price of MVI has increased from $42.02 on May 29 to its current value of $118.06, reflecting a gain of 180% compared to the 20% rise in the total market cap.

Metaverse and nonfungible token (NFT)-related projects have been a bright spot in an otherwise weak market over the past six months and in this instance, it was beneficial to be invested in a basket of metaverse tokens.

The Data Economy Index and Bankless DeFi Innovation Index have both posted losses since launching. This mirrors the performance of the wider crypto market, which has been in a downtrend since peaking in early November 2022.

NFT Index

NFTs have been one of the hottest sectors of the past year, but finding the next big crowd-pleaser is a monumental challenge because dozens of new NFT projects launch on a daily basis.

An alternative for gaining exposure is the NFT Index (NFTI), a basket that contains 11 different tokens including Polygon (MATIC), ApeCoin (APE), The Sandbox (SAND) and Decentraland (MANA).

The price of NFTI has increased from $386 on March 5, 2021, to its current price of $1,724, a gain of nearly 350%. During that same period of time, the total crypto market capitalization rose by 30%, providing evidence of the strength the NFT market has seen over the past 13 months.

eToro baskets

For those looking for exposure to crypto baskets in a more regulated environment, eToro, a multi-asset brokerage firm, provides access to several “smart portfolio” options that have performed well over the past year.

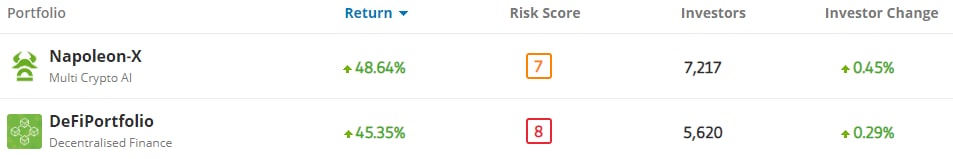

The Napoleon-X smart portfolio is a basket comprising some of the more established projects in the crypto market, including Bitcoin (BTC), Ether, BNB, Litecoin (LTC) and Cardano (ADA). The DeFiPortfolio contains a large allocation of Ether along with smaller allocations to other projects that are involved in the DeFi sector including Polygon and Algorand.

As shown in the graphic above, these portfolios have provided returns of 48.6% and 45.3% over the past year while the total crypto market cap has actually declined 5.71% during the same time period.

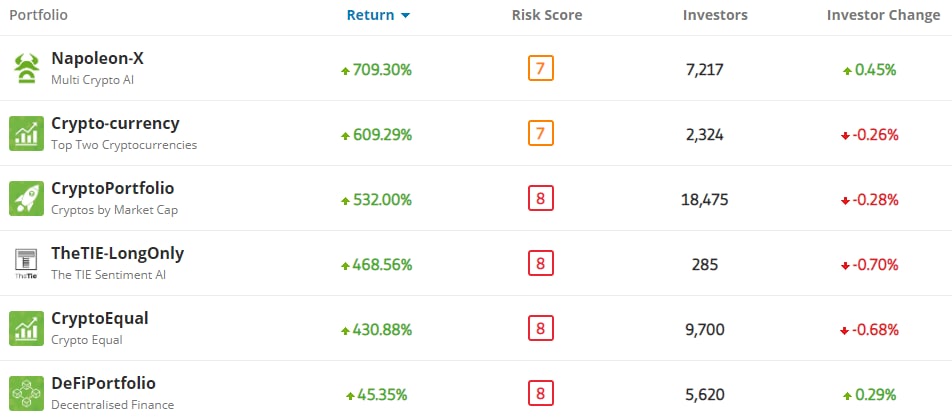

On a two-year time scale, several of the eToro portfolios have offered returns in excess of 430% including Napoleon-X, which has experienced an increase of 709.3%. During that same time period, the total crypto market cap has increased 808%, while the price of BTC has increased by 472%.

This suggests that indexes offer the opportunity to capture a large percentage of the overall gains in the market while offering a better return. In many instances, this is a better tactic than trying to pick individual tokens that will see the biggest gains.

The results for DeFiPortfolio also highlight the importance of taking profits when big gains are made because they have a tendency to slip away as traders rotate or whipsaw price movements occur.

Want more information about trading and investing in crypto markets?

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Comments are closed.