Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

$1T opportunity: JPMorgan becomes first major bank in the metaverse

United States banking giant JPMorgan Chase has taken a dive into what it considers a significant up and coming arena of opportunity: the metaverse. The bank has recently opened a digital lounge called Onyx in Decentraland’s metaverse. Decentraland serves as one of many crypto industry projects utilizing blockchain to provide a digital world experience — in other words, a metaverse.

JPMorgan sees significant potential in the new movement toward digital worlds. “The metaverse will likely infiltrate every sector in some way in the coming years, with the market opportunity estimated at over $1 trillion in yearly revenues,” the bank said in a report. However, to reach its potential, the metaverse movement requires further development in several key areas, the report said.

Onyx is also the name of JPMorgan’s blockchain-based payments system.

FBI is launching team to address crypto exploitation: US Deputy Attorney General

The U.S. Federal Bureau of Investigation (FBI) is putting together a special unit to go after illegal crypto activity, such as ransomware attacks. Armed with experts wielding knowledge of the digital asset space, the Virtual Asset Exploitation Unit will be the FBI’s team on the crypto crime front, according to comments from U.S. Deputy Attorney General Lisa Monaco at the Munich Cyber Security Conference.

“Ransomware and digital extortion, like many other crimes fueled by cryptocurrency, only work if the bad guys get paid, which means we have to bust their business model,” Monaco explained. The new FBI team will act alongside the National Cryptocurrency Enforcement Team, which is headed up by the U.S. Department of Justice (DOJ). The DOJ also has plans to fight crypto crime on an international level, according to Monaco.

SEC hits BlockFi with a $100 million penalty, gives 60 days to comply with a 1940 law

BlockFi came to terms with regulators this week in response to resistance from the U.S. Securities and Exchange Commission (SEC), which had labeled the BlockFi Interest Account as a securities product. Operating since 2019, the offering in question from BlockFi lets users loan crypto and receive notable interest in return.

BlockFi agreed to pay the SEC $50 million as penalty. In addition, 32 U.S. states took action against BlockFi, resulting in a further $50 million that BlockFi must pay to those regions — tallying $100 million total in penalties.

Moving forward, BlockFi has a 60-day period to align the product with the Investment Company Act of 1940. In the meantime, BlockFi will halt onboarding new users until it becomes compliant with the regulation.

Digital ruble trial goes live as Bank of Russia insists on Bitcoin ban

The Bank of Russia announced this week that initial testing for its central bank digital currency (CBDC) was successful after several transfers of the digital ruble were made to Russian citizens. A total of 12 financial institutions participated in the digital ruble pilot program, putting the central bank on track to launch its CBDC program later this year.

The CBDC news came after anti-crypto comments from the head of the Bank of Russia, Elvira Nabiullina, the prior week. Because CDBCs are under the direct control of governments, they differ from traditional cryptocurrencies such as Bitcoin.

Cointelegraph releases Top 100 in Crypto and Blockchain 2022

This week, Cointelegraph unveiled its 2022 list of the top 100 most influential figures in the crypto and blockchain space. The Top 100 includes profiles of people and trends that impacted the crypto and blockchain space in 2021. Each profile also includes an overview of what we can expect from each influencer or trend for the remainder of 2022.

Cointelegraph will unveil the list over the course of the coming days, releasing 10 profiles per day until all 100 are shown. The first group of 10 was revealed on Thursday, with Rekt Capital starting off the list at number 100.

Cointelegraph has released prior installments of its top 100 list in previous years.

Winners and Losers

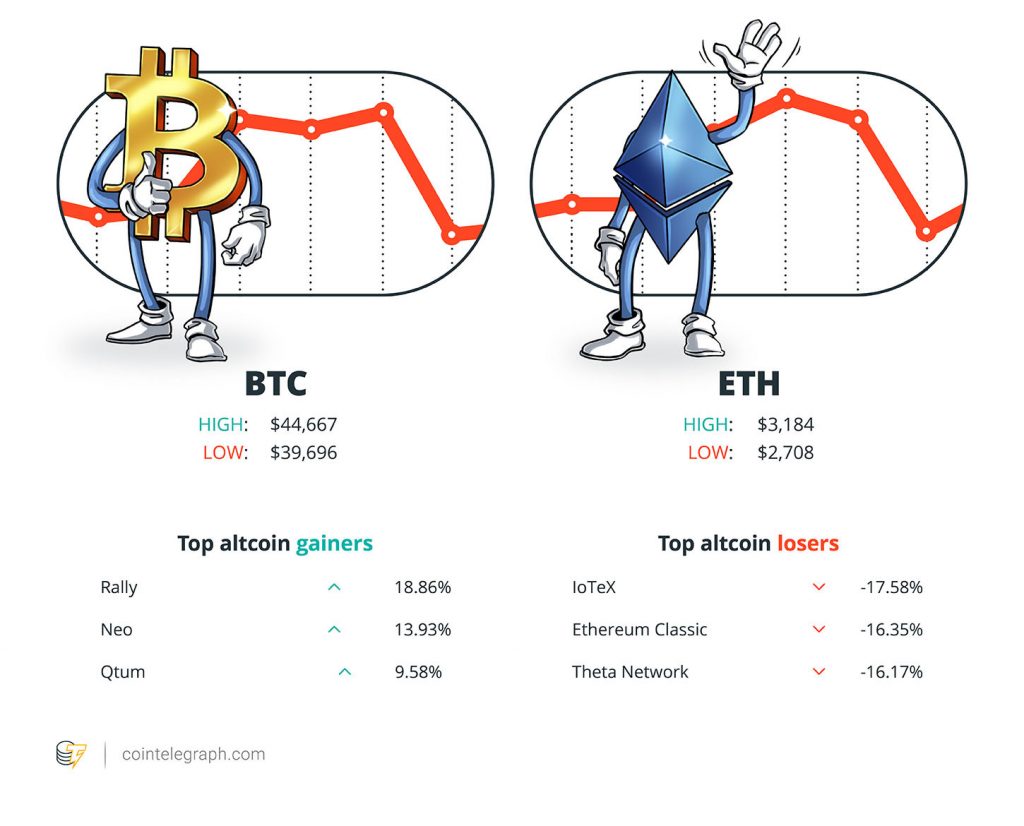

At the end of the week, Bitcoin (BTC) is at $40,036, Ether (ETH) at $2,790 and XRP at $0.77. The total market cap is at $1.81 trillion, according to CoinMarketCap.

At the end of the week, Bitcoin (BTC) is at $40,036, Ether (ETH) at $2,790 and XRP at $0.77. The total market cap is at $1.81 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Rally (RLY) at 18.86%, Neo (NEO) at 13.93% and Qtum (QTUM) at 9.58%.

The top three altcoin losers of the week are IoTeX (IOTX) at -17.58%, Ethereum Classic (ETC) at -16.35% and Theta Network (THETA) at -16.17%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“We’re literally burning the gas into the atmosphere just because it’s not economical to do anything with it. Instead, we can put it into a motor to produce electricity and use that to mine Bitcoin.”

Kristian Csepcsar, chief marketing officer at Slush Pool

“I mean, we can call them a gamble, but at the end, we always knew v1 [CryptoPunks] were not legit punks; they were simply artifacts that led to the creation of Punks. So they have a place in history, but I doubt that place is worth 1K ETH, lol.”

lookinrare#0911, Discord user

“It is becoming clear, however, that 2022 shall be a pivotal year when it comes to crypto-assets management.”

Thomas Campione, blockchain and crypto-assets leader at PwC Luxembourg

“I know the big ones (Bitcoiners) live in Portugal already. They are anonymous. They are not like me out there, but they already are here. They are spending their money on houses; they are spending their Bitcoins on everything.”

Didi Taihuttu, father of the Bitcoin Family

“We expect by this summer — pretty soon — to accept crypto for all of our state tax-related purposes.”

Jared Polis, governor of Colorado

“El Salvador’s adoption of Bitcoin as legal tender raises significant concerns about the economic stability and financial integrity of a vulnerable U.S. trading partner in Central America.”

James Risch, United States senator

“I certainly didn’t invest in crypto. I’m proud of the fact that I avoided it. It’s like some venereal disease.”

Charlie Munger, vice chairman of Berkshire Hathaway

“We have to abolish the last privilege of the rich, the financial ignorance.”

Christophe de Beukelaer, member of the Parliament of the Brussels-Capital Region

Prediction of the Week

BTC price dips below $40K as Wall Street open spells pain for Bitcoin bulls

Bitcoin turned lower in a somewhat turbulent week for markets. The asset tapped almost $45,000 on Tuesday before falling to around $39,500 by Friday, according to Cointelegraph’s BTC price index.

Twitter personality and trader Rekt Capital expects Bitcoin to continue range-bound price movement within the bottom half of a sizable “macro” price range spanning from about $30,000 to $69,000. “$BTC will continue to occupy the lower half of the macro range until further notice,” Rekt Capital said in a tweet.

FUD of the Week

UK tax authority makes first NFT seizure in VAT fraud case

UK tax authority makes first NFT seizure in VAT fraud case

Three individuals were apprehended for allegedly dodging taxes owed to the United Kingdom’s government, with the country’s taxation body, Her Majesty’s Revenue and Customs, taking control of three nonfungible tokens (NFTs) in the process.

The confiscated NFTs were considered seized assets and were not used by the suspects in their purported tax evasion scheme. Under false identities, the suspects allegedly avoided value-added taxes to the tune of $1.8 million by utilizing over 200 phony companies.

4% of crypto whales are criminals, and they hold $25B among them: Chainalysis

Over 4,000 big crypto players have allegedly amassed some of their wealth via questionable means, according to a new report from Chainalysis. The report noted 4,068 questionable crypto whales in the industry, as per 2021 and 2022 data.

Chainalysis classifies criminal whales as private crypto wallets holding more than $1 million worth of digital assets, with more than 10% of their balances coming from illicit addresses. The write-up from Chainalysis also included a bevy of additional information.

Canada invokes ‘Emergencies Act’ targeting crowdfunding and crypto

On Tuesday, Canadian Prime Minister Justin Trudeau invoked the Emergencies Act in an attempt to block fundraising efforts by the self-styled “Freedom Convoy,” which has been staging large-scale protests across the country. According to Chrystia Freeland, Canadian deputy prime minister, the move to block funds falls under the umbrella of protection against terrorist financing.

Donors had contributed over $19 million to the protestors through online fundraising platforms GoFundMe and GiveSendGo. Since those funds have been blocked from reaching the protestors, some donors have resorted to funding the movement using Bitcoin.

Best Cointelegraph Features

Crypto innovators of color restricted by the rules aimed to protect them

Crypto innovators of color restricted by the rules aimed to protect them

“It’s an evolution here in the U.S. moreso — technologies are adopted by the wealthier people first […] and then onto others.”

Crypto at the Olympics: NFT skis, Bitcoin bobsledders and CBDC controversy

Bitcoin and nonfungible tokens are all over the Olympics this year while China’s CBDC is there too amid a controversial rollout.

Wormhole hack illustrates danger of DeFi cross-chain bridges

The second-largest decentralized finance hack to date brings about questions about the Solana ecosystem and cross-chain protocols.

Comments are closed.